Earlier, when we heard about healthcare insurance, we associated it with lengthy paperwork, complex claim processes, and slow reimbursements. It was frustrating for both customers and insurers. Today, technology is changing that narrative, and for the good. And the flag bearer of this shift is Artificial Intelligence(AI).

With the advancements in AI, insurers now have robust tools to simplify policy management, claims processing, fraud detection, and even customer engagement. Modern Healthcare Insurance App Development leverages AI to offer intelligent features that predict risks, personalize coverage, and streamline operations end-to-end.

According to the NAIC survey, 84% of health insurance companies report they use AI and ML in some capacity. This indicates that insurers are seeing massive potential in this technology, which is why they are investing in insurance app development.

In this article, we will walk through how AI is rewriting healthcare insurance apps, the benefits and challenges of adopting it, and how it is catalyzing new insurance business models.

Why AI Matters in Healthcare Insurance App Development

Health insurance is one of the most data-intensive industries. Every customer has tons of data related to their personal information, medical histories, lifestyle patterns, claims records, and policy information. So, managing these chunks of data manually becomes difficult and is full of errors. However, AI solves this challenge by:

- AI helps automate repetitive tasks such as policy renewals and claim validations.

- It detects fraud through real-time pattern analysis.

- AI provides personalized recommendations through ML-driven algorithms and data-driven insights.

- It also offers customer support and query resolution with AI-powered chatbots and AI agents.

By integrating AI into insurance mobile app development, insurance companies are shifting from reactive processes (fixing issues after they occur) to proactive models (predicting and preventing issues).

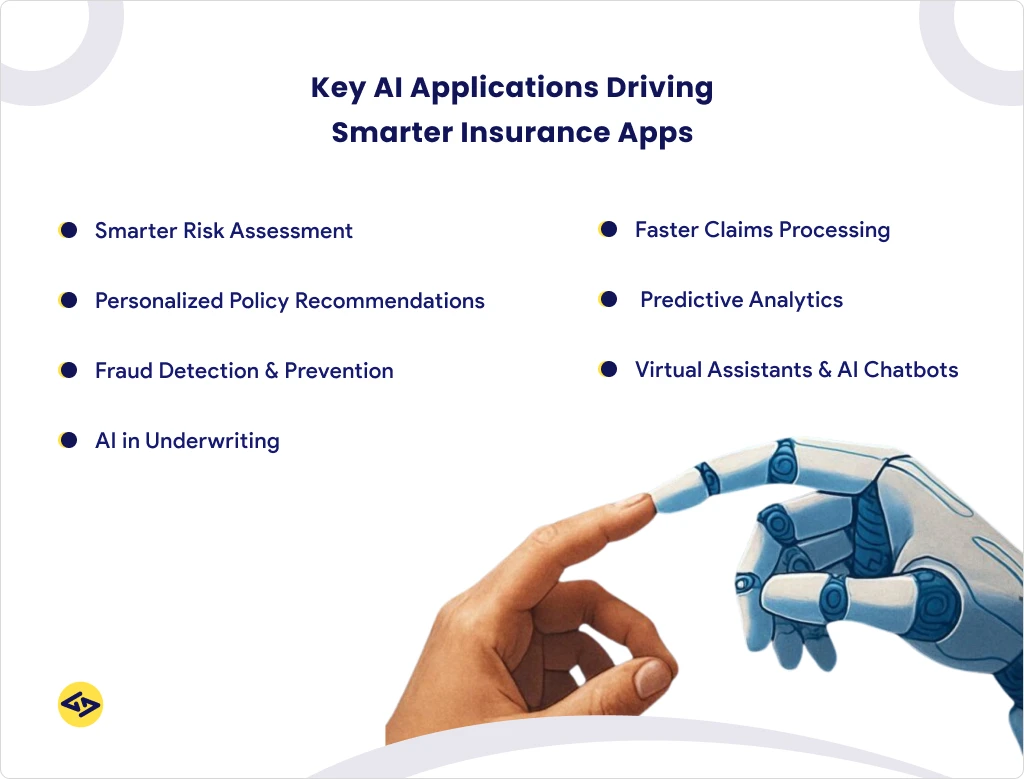

Key Use Cases of AI in Insurance App Development

By now, you might have got an idea of why AI is necessary in the insurance sector. Let’s explore how AI is being applied.

1. Smarter Risk Assessment

The insurance business model runs primarily on risk assessment. Earlier, insurance companies assessed risks based on a few questionnaires, basic medical checks, and, most importantly, historical data. It’s still relevant in today’s scenario, but AI has expanded this process by accessing data from wearable devices, EHRs, and even lifestyle choices.

For example, your application can track activity levels from a fitness watch and use AI to recommend lower premiums for users with healthy habits.

2. Faster Claims Processing

Today, delayed claim approvals are the biggest drawback for policyholders. However, with AI-backed health care apps, claim processing becomes faster and more accurate.

For instance:

- AI can quickly read uploaded claim documents using OCR technology.

- It can cross-check claim details with hospital records and other databases.

- The best aspect is that AI can flag suspicious or duplicated claims easily.

This reduces processing time from weeks to hours, which is beneficial for both insurers and customers.

3. Fraud Detection and Prevention

Insurance fraud drains billions of dollars globally each year. Fraudulent claims, identity theft, and inflated medical bills create huge losses. AI is a powerful weapon against this.

Using machine learning algorithms, insurance apps can detect unusual claim patterns, verify patient identities, and compare claims against past medical histories. For example, if an app detects the same individual filing claims from multiple locations in a short time, it can flag it immediately.

Integrating such features into insurance mobile app development ensures greater security and trust.

4. Personalized Policy Recommendations

AI makes healthcare insurance more customer-centric. Instead of one-size-fits-all policies, apps can recommend personalized coverage.

For example:

- A young customer may be offered affordable preventive health plans.

- A senior citizen may get policies covering chronic illnesses.

- Families may receive bundled policies with child coverage.

This level of personalization in insurance app development strengthens customer loyalty and improves retention rates.

5. Virtual Assistants, Chatbots, and AI Agents

The next boom in the health insurance sector is on the horizon, driven by AI-powered chatbots, virtual assistants, and AI agents. These intelligent bots will make insurance apps more user-friendly and advanced.

They can:

- Answer policy-related FAQs instantly.

- They can guide users through claims submission.

- Send premium reminders so that users do not forget.

- Recommend wellness programs to enhance patient care.

These features ensure round-the-clock support without requiring large call center teams, making them a key feature in modern insurance app development solutions.

6. Predictive Analytics for Better Decisions

Predictive analytics employs historical data to predict future events. In healthcare insurance, this is crucial for risk management.

AI-powered predictive analytics can:

- Estimate future claim probabilities to hold the right amount for payouts.

- Identify high-risk customers early to provide more suitable plans.

- Help insurers set fair premium rates by assessing beforehand.

For example, if AI predicts a higher probability of heart disease for a customer based on lifestyle data, insurers can encourage preventive care. This strengthens the insurance business model by reducing long-term costs.

8. AI in Underwriting

Underwriting determines policy terms and premium amounts. Traditionally, it was a manual and slow process. AI speeds this up while improving accuracy.

By accessing data from various sources, AI ensures fair pricing and reduces the risks of under- or overcharging customers. This creates a more transparent insurance business model, where premiums reflect actual health conditions and lifestyles.

The ROI of Healthcare Insurance Apps

When you invest in an AI-led insurance app development, initially, it may seem costly. However, it fetches significant ROI in the long run. Let’s check what benefits it can provide:

- With the help of automation, you can reduce operational costs.

- Personalization helps achieve higher customer retention.

- AI in health insurance apps offers lower fraud-related losses.

- Faster market growth by adopting innovative insurance app development solutions.

In simple terms, health insurance firms that leverage AI today will reap advantages going forward.

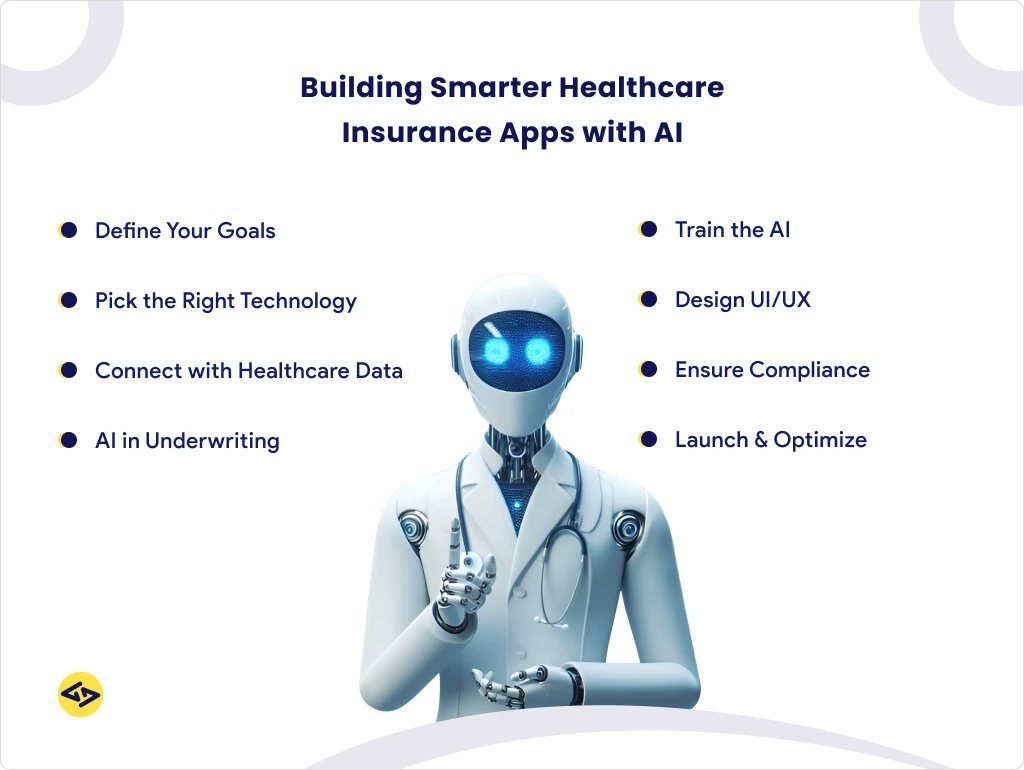

How to Build a Healthcare Insurance App

If you’re an insurer thinking about building a healthcare insurance app powered by AI, you just need to follow a step-by-step approach. Let’s have a look below:

1) Start with Your Goals

At first, decide what you want the app to do. Do you want it to make claim filing easier? Should it help assess risks? Or do you want to improve customer service? Having clear goals will keep the project on track.

2) Pick the Right Technology

Next, you’ll need the right tools. In this case, your toolkit may include AI frameworks like TensorFlow or PyTorch, along with cloud platforms and strong security tools to keep data safe.

3) Connect with Healthcare Data

Once the basics are ready, it’s time to connect them with healthcare systems. This means linking it to EHRs, wearable devices (like fitness trackers), and hospital databases through APIs. That way, the app can instantly pull in useful information.

4) Train the AI

In this step, you need to train the algorithms on real medical and insurance data so they can make accurate predictions and reduce mistakes.

5) Design UI/UX

Even the most intelligent app won’t succeed in the market if people find it hard to use. So, make the design simple, clean, and user-friendly. Your goal must be to ensure that even someone with no technical background can navigate the app easily.

6) Be Compliance-ready

Because you’re dealing with sensitive medical data, compliance is a must. Regulations like HIPAA and GDPR are there to protect user privacy, so your app has to meet these standards.

7) Launch and Optimize

Finally, roll out the app to your users. After that, you should collect feedback and make updates regularly. This way, the app gets better with every version.

Challenges to Consider

While Artificial Intelligence brings several benefits, it also comes with industry-specific challenges. Let’s check out significant challenges in implementing AI in healthcare insurance.

- As a decision-maker, you might have to pay high development costs for advanced solutions.

- There is a chance of data privacy risks when you deal with sensitive medical information.

- Additionally, AI Bias and AI hallucination could lead to unfair risk predictions.

- The biggest challenge will be AI integration with legacy systems.

However, companies can overcome these challenges with careful planning, hiring skilled developers, and implementing strict cybersecurity measures.

The Future of AI in the Insurance Business Model

In the future, AI will play a significant role in the healthcare insurance space. Let’s look at some of the trends you can expect:

- With the combination of Blockchain and AI, insurance claims will be more secure and transparent.

- Insurers can offer AI-driven Preventive Care with more focus on wellness policies.

- Voice AI Assistants will provide extensive hands-free policy management.

- Insurance companies can create hyper-personalized plans based on real-time lifestyle monitoring.

These innovations will assist the insurance business model to be more personalized, preventive, and highly customer-driven.

Wrapping Up: The Future of Healthcare Insurance App Development

Artificial Intelligence has become imperative for insurance agencies that want to stay agile and competitive in this digital era. By using AI in insurance app development solutions, insurers can enhance efficiency, cut costs, detect fraud, and develop stronger relationships with their customers. In the future, AI-assisted health insurance apps will become your proactive health partners. This change will catalyze the growth of insurance and make it smarter, faster, and more human.

Revolutionize Your Insurance App with AI

Leverage AI-powered solutions to streamline claims, enhance customer experience, and stay ahead in the competitive healthcare insurance market.