Chances are, you have used Zomato at least once. But do you know how this popular restaurant discovery and food delivery platform works behind the scenes? This blog post will take a deep dive into the Zomato Business Model, revenue streams, and operations.

From its humble beginnings as an online menu card to its current status as one of India’s most successful tech startups—now a publicly listed company focused primarily on the Indian market—we’ll explore everything that makes Zomato tick. So sit back, relax, and get ready to learn all about how Zomato’s business works.

If you’re planning to build your own food delivery app like Zomato, don’t miss our detailed guide on the cost to build an app like Zomato for a realistic budget breakdown.

What is Zomato & How Did Zomato Start?

Zomato is an Indian restaurant aggregator and food delivery company. It was founded by Deepinder Goyal and Pankaj Chaddah in 2008.

In July 2008, Deepinder Goyal and Pankaj Chaddah, both graduates of the prestigious Indian Institutes of Technology (IIT), joined forces to establish Zomato, initially known as Foodiebay. The inception of Zomato stemmed from Deepinder’s observation that his colleagues often struggled with paper menus while ordering food from various restaurants. Recognizing the need for a more convenient and accessible solution, they embarked on transforming restaurant menus into a user-friendly digital platform.

Within a mere nine months, Zomato emerged as Delhi’s premier dining directory, swiftly expanding its reach to other cities fueled by its initial success. By 2012, Zomato embarked on an ambitious international expansion, venturing into countries such as the United Kingdom, South Africa, Sri Lanka, New Zealand, and Brazil, among others. However, to avoid potential legal conflicts arising from the resemblance of its former name ‘Foodiebay’ to ‘eBay,’ the company underwent a rebranding in 2010, officially adopting the name ‘Zomato.’

In 2015, Zomato diversified its portfolio by venturing deeper into food delivery and introducing Gold in India, a subscription-based product offering complimentary food and beverage items to subscribers (later rebranded and evolved into newer loyalty offerings). In the following years, Zomato also launched HyperPure, a venture aimed at collaborating directly with farmers and food producers to enhance the quality of food products supplied to restaurants, ensuring freshness and sustainability.

Over the years, Zomato has also experimented with ultra-fast food concepts like Zomato Instant, Zomato Everyday, and Zomato Quick. These initiatives have since been discontinued or significantly scaled back, as the company chose to focus on sustainable unit economics in food delivery and quick commerce through Blinkit.

If you are in the food & beverages industry and want to digitize your restaurant or cloud kitchen similar to Zomato’s partners, you can explore tailored food & beverage software solutions to manage ordering, delivery, and operations.

Funding History

Zomato has garnered substantial funding from various investors throughout its journey. Notably, the leading early investor is Info Edge, with significant contributions from Ant Financial (an Alibaba affiliate), Delivery Hero, Shunwei Capital, Vy Capital, and several others, contributing to Zomato’s growth and eventual IPO.

Some key milestones in Zomato’s funding and growth history:

- November 2013: Secured around $37 million from Sequoia Capital and Info Edge India.

- November 2014: Raised around $60 million from Vy Capital, Info Edge, and Sequoia Capital, fueling product and geographic expansion.

- September 2015: Raised $60 million from Temasek and Vy Capital.

- 2018: Received a major investment from Ant Financial (an Alibaba affiliate), along with additional follow‑on funding.

- July 2021: Launched its IPO on NSE/BSE, raising approximately $1.26 billion and becoming a publicly listed company.

- August 2022: Acquired Blinkit (formerly Grofers) in an all‑stock deal, entering the quick commerce space in a big way.

Zomato now houses its key businesses—food delivery, Blinkit (quick commerce), HyperPure (B2B supplies), Dineout (dining‑out and payments), and other smaller initiatives—under the broader Eternal Limited holding structure. This structure allows Zomato to allocate capital across verticals more efficiently—investing more in high‑growth areas like Blinkit and HyperPure, while optimizing or exiting slower or non‑core experiments.

For more detailed financial information, you can refer to Zomato’s official investor relations page. To see the latest data and strategic commentary on business performance, including Blinkit’s rapid growth, their Q4 FY25 Letter to Shareholders is an excellent resource.

Operational Insights

Zomato’s scale and operations have evolved significantly:

- Zomato, together with Blinkit and HyperPure, employs thousands of people across technology, operations, sales, and support roles.

- The delivery operations are powered by a massive fleet of independent delivery partners, numbering in the hundreds of thousands, who are managed through a sophisticated logistics platform.

- The platform serves tens of millions of monthly active users, primarily in India, across food delivery, quick commerce, and dining‑out use cases.

- Zomato is available in multiple languages and has historically supported markets such as the UAE and other international regions, but its primary focus today is India.

- Over time, Zomato has expanded its ecosystem beyond discovery and delivery to include:

- Blinkit – ultra‑fast delivery of groceries and essentials

- HyperPure – supplies and ingredients for restaurants

- Dineout – an integrated feature for dining‑out, table reservations, and in‑restaurant payments

- Feeding India – Zomato’s not‑for‑profit initiative focused on fighting hunger and food waste

At iCoderz, we’ve helped multiple startups build scalable food delivery and quick commerce platforms inspired by models like Zomato and Blinkit. You can review some real‑world implementations in our on‑demand project portfolio.

GMV vs Revenue: What Does Zomato Actually Earn?

Before diving into the business model, it’s important to distinguish between:

- GMV (Gross Merchandise Value): The total value of all orders placed on Zomato’s platform (food, groceries, etc.).

- Revenue: The portion of GMV that Zomato actually keeps—commissions, fees, margins on Blinkit orders, ad revenues, subscriptions, etc.

For example, if a user places a ₹500 food order, the restaurant may keep most of that amount, while Zomato earns only the commission and fees on top. This marketplace structure is central to understanding why Zomato’s reported revenue is much smaller than its total GMV, but still very attractive when scaled across millions of orders.

How Zomato’s Ecosystem Works and Generates Revenue

Zomato operates a three-sided marketplace that connects millions of users with restaurants and merchants through a network of delivery partners. Here’s a breakdown of how user actions on the platform translate directly into revenue for the company.

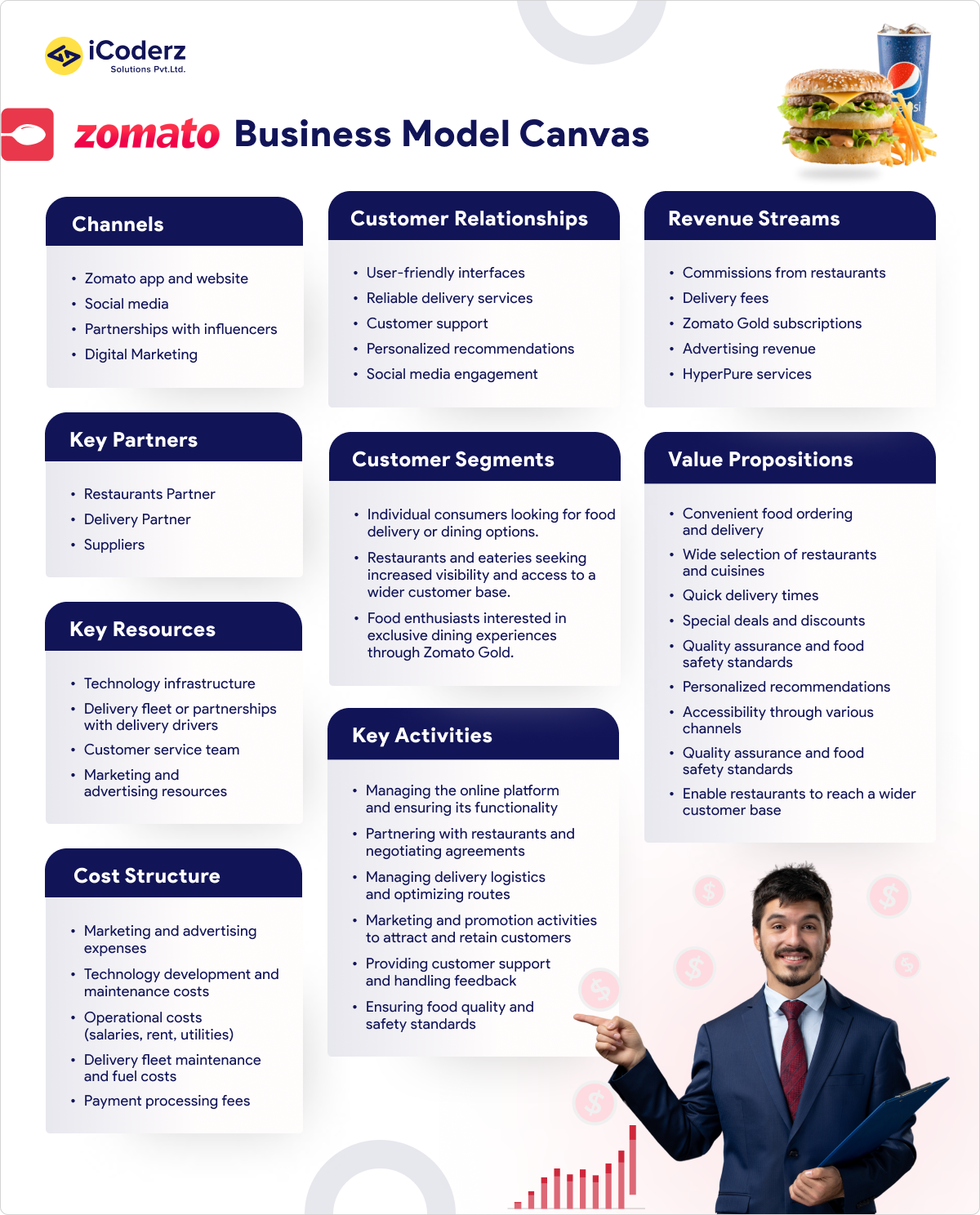

1. Discovery and Advertising

The user journey typically begins with discovery. A user searches for restaurants by location, cuisine, or name, browsing menus, photos, and reviews. Zomato monetizes this massive user traffic by charging restaurants for sponsored listings and priority placement, allowing them to appear higher in search results. For dining out, the integrated Dineout feature allows users to book tables and access exclusive offers, creating another monetization channel through restaurant partnerships.

2. The Logistics Layer: Delivery Partners

The crucial link in the chain is Zomato’s vast fleet of delivery partners. These are independent contractors (gig workers) who use their own vehicles and are managed via a dedicated driver app. They accept orders, navigate to restaurants, and deliver to the customer’s doorstep. They are a critical variable cost in the business model, and their efficiency and service directly impact customer satisfaction and Zomato’s profitability.

3. Ordering and Delivery

Once a user places an order, Zomato’s core marketplace engine kicks in, assigning the order to a delivery partner. The platform processes the payment for the entire transaction. Revenue here comes from two sides: Zomato charges the restaurant a commission (a percentage of the order value) and also charges the user delivery fees and a small platform/convenience fee.

4. Quick Commerce (Blinkit)

Integrated within the Zomato app, a user can switch to Blinkit for ultra-fast delivery of groceries and essentials. Unlike the food delivery marketplace, this model is often inventory-led. Revenue is primarily generated from the margin on products sold from Blinkit’s network of dark stores, supplemented by delivery fees. This vertical has become a key driver of Zomato’s growth and profitability.

5. Subscriptions and Loyalty

To encourage repeat business, Zomato offers subscription programs like Zomato Gold. Users pay a recurring fee for benefits like free delivery and special discounts. This creates a predictable subscription revenue stream for Zomato while increasing user retention and order frequency, which boosts the value of the entire ecosystem.

6. B2B Supplies (HyperPure)

Beyond the consumer-facing app, Zomato serves its restaurant partners through HyperPure, a B2B supply chain service. Restaurants can order fresh ingredients and kitchen supplies directly from Zomato. This generates revenue through the margin on the sale of these supplies, strengthening the relationship with restaurant partners and creating a more resilient business model.

Zomato’s Path to Profitability & Unit Economics

Historically, Zomato (like most delivery players) focused on rapid growth, often operating at a loss due to heavy discounts and high logistics expenses. Over time, the company has shifted its focus towards:

- Improving take‑rates: Optimizing commission structures and platform fees from restaurants and customers.

- Reducing discount burn: Moving away from deep, unsustainable discounts towards more targeted promotions and loyalty benefits.

- Better delivery efficiency: Improving rider utilization, batching orders, and route optimization to reduce per‑order delivery costs.

- Higher-margin verticals: Scaling Blinkit and HyperPure, which can generate better margins compared to pure food delivery.

This shift has helped Zomato move towards EBITDA profitability at a consolidated level, while still growing its order volumes and GMV.

Zomato Business Model Canvas

Customer Acquisition & Retention: Why Users Stay on Zomato

From a business model perspective, Zomato’s ability to keep users coming back is crucial. It does this through:

- Frequent offers and personalized deals

- Subscription/loyalty products (like Gold/Pro‑style benefits)

- A strong review and rating ecosystem that builds trust

- A smooth user experience across search, ordering, tracking, and support

High user retention directly boosts order frequency and average order value (AOV), which in turn increases the commissions, fees, and ad revenue Zomato can earn over the long term.

If you’re a restaurant owner, cloud kitchen founder, or aggregator planning to digitize your operations similar to Zomato, food delivery app development can help you build a custom platform with customer, restaurant, and driver apps plus a powerful admin panel.

Want to know the cost estimation for developing an app similar to Zomato? Read our in‑depth breakdown here: How much does it cost to build an app like Zomato.

Challenges Faced by Zomato

The platform has faced several challenges over the years. Below are some of the significant challenges faced by Zomato:

1) Intense Competition:

Zomato operates in a highly competitive market, with several players, including Swiggy. The intense competition puts much pressure on Zomato to keep innovating, offer better services, and keep prices low to retain and attract customers. In recent years, competition has also intensified in quick commerce, with players like Zepto and BigBasket’s BB Now pushing Zomato to invest heavily in Blinkit’s expansion and innovation.

2) Logistics and Delivery Challenges:

One of the primary challenges faced by Zomato is the logistics and delivery of food. The company has to ensure that food is delivered on time and in good condition. Delays and mishandling can lead to dissatisfied customers and negative reviews. This also involves managing the satisfaction, retention, and performance of a massive, decentralized fleet of gig-economy delivery partners, which comes with its own set of operational and regulatory complexities.

3) Managing Quality Standards:

Zomato works with numerous restaurant partners, and it can be a challenge to maintain consistent quality standards across all partners. Ensuring food is prepared and served correctly, and adheres to hygiene and safety standards, is essential for customer satisfaction and brand reputation.

4) Dependence on Third-party Vendors:

Zomato relies on third-party vendors for many of its operations, including payment processing. This dependence can create challenges, including disruptions in the supply chain and increased costs.

5) Regulatory Challenges:

The food delivery industry is heavily regulated, and Zomato has to comply with various regulations, including food safety standards, taxes, and labor laws related to the gig economy. Complying with these regulations can be challenging, time-consuming, and costly.

6) Managing Growth with Profitability:

Zomato has experienced rapid growth, expanding into new markets and services. Post‑IPO, balancing this growth with profitability is critical. Zomato has shown meaningful improvement in consolidated EBITDA since FY24, as it scales its high-growth verticals under the Eternal Limited structure.

7) Data Privacy and Security:

Zomato collects and stores sensitive customer information, including payment details and personal information. Ensuring this information is kept secure and protected from data breaches is crucial to maintaining customer trust and complying with data protection regulations.

Future Outlook from a Business Model Lens

Looking ahead, Zomato’s business model is likely to deepen along a few dimensions:

- AI‑driven personalization: Better recommendations can increase conversion rates and average order values.

- Fintech & payments: Deeper integration of payments and credit (e.g., pay‑later, co‑branded offers) can unlock new monetization opportunities.

- SaaS tools for restaurants: Advanced analytics, CRM, and marketing tools could become paid add‑ons for high‑value restaurant partners.

All of these are extensions of the same core idea: Zomato monetizes the demand it aggregates and the data it generates, across food, groceries, and restaurant services.

Conclusion

Zomato is a revolutionary food‑tech and delivery service that has transformed how millions of people discover, order, and enjoy food. It has become one of India’s most successful tech companies by leveraging its deep understanding of customers and creating an efficient online platform.

Zomato’s Business and Revenue Model, now spanning food delivery, quick commerce (Blinkit), HyperPure supplies, and dining‑out through Dineout, has enabled it to build one of the largest food‑ordering and quick‑commerce networks in India. With its continuously evolving portfolio and focus on profitable growth, Zomato is likely to remain a dominant player in this space for many years.

If you’re inspired by the Zomato business model and want to build a similar food delivery or quick commerce platform, you can contact iCoderz Solutions to discuss your idea and get a custom strategy, design, and development plan tailored to your business.

Want to Create a Zomato-Style App?

Our team helps you turn your idea into a fast, feature-rich, and profitable food delivery product.